A fundamental tool for the Latin American Tax Administrations: the exchange of Tax Information | Inter-American Center of Tax Administrations

A fundamental tool for the Latin American Tax Administrations: the exchange of Tax Information | Inter-American Center of Tax Administrations

Automatic Exchange of Information: Guide on Promoting and Assessing Compliance by Financial Institutions - OECD

Standard for Automatic Exchange of Financial Account Information in Tax Matters: Organization for Economic Cooperation and Development: 9789264267985: Amazon.com: Books

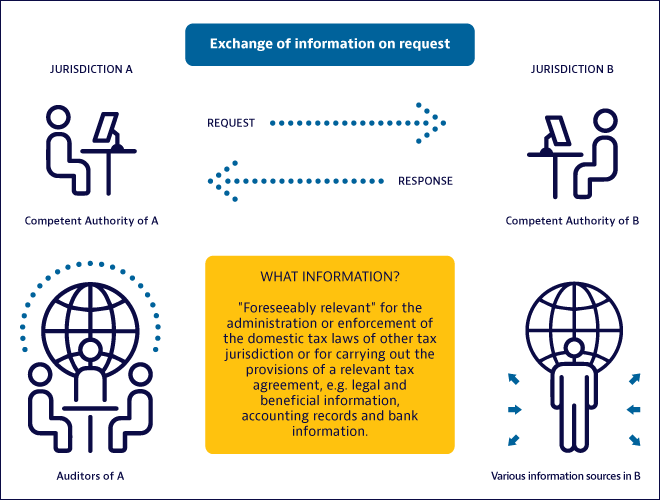

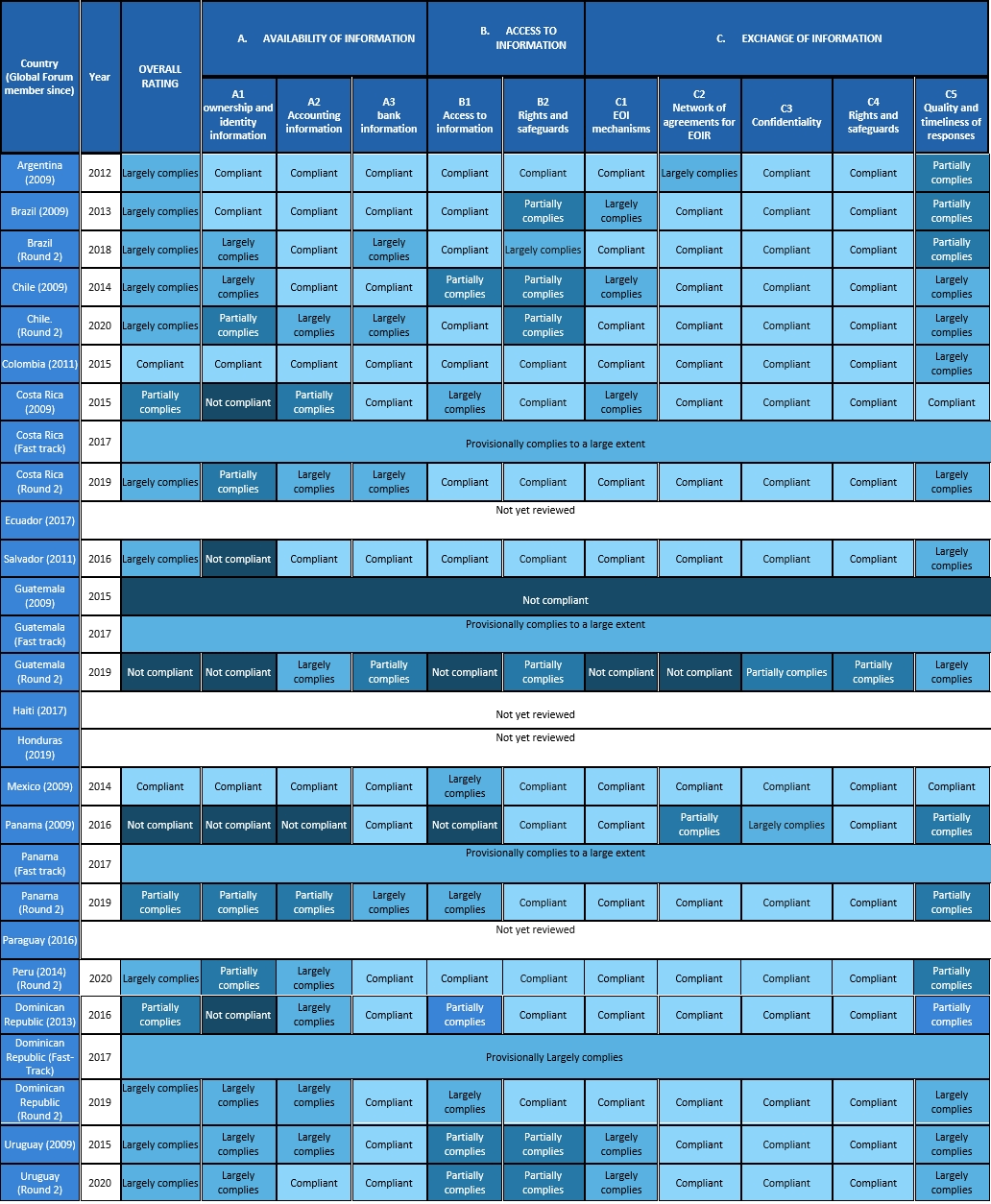

A fundamental tool for the Latin American Tax Administrations: the exchange of Tax Information | Inter-American Center of Tax Administrations

Standard for Automatic Exchange of Financial Account Information in Tax Matters: Implementation Handbook - OECD

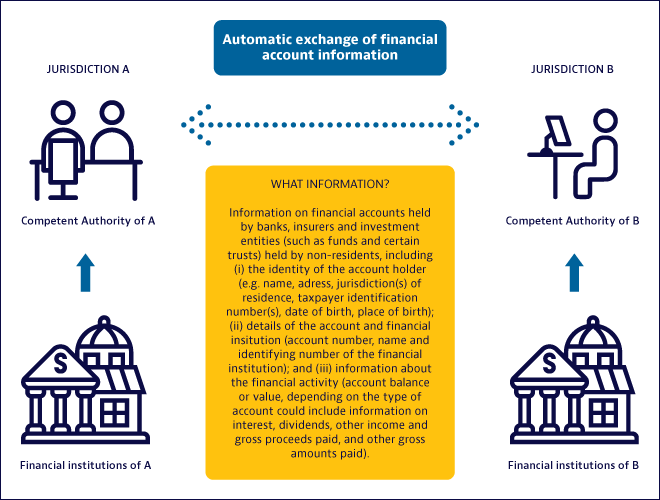

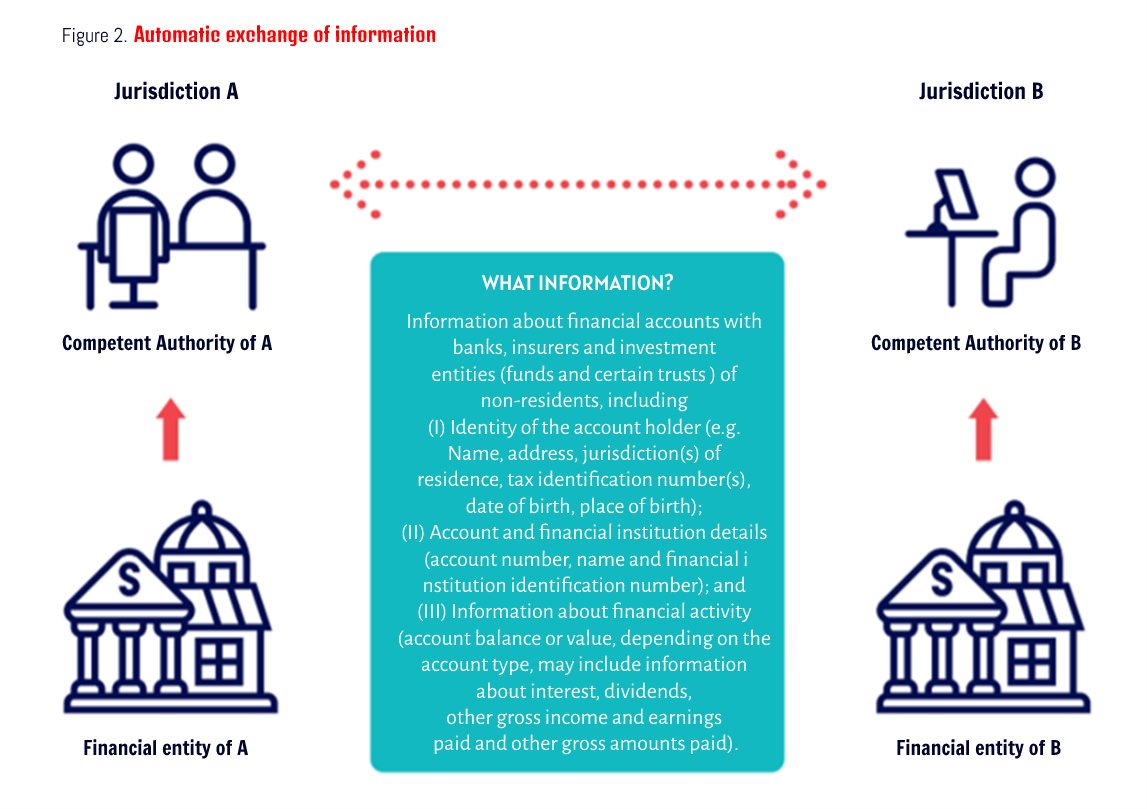

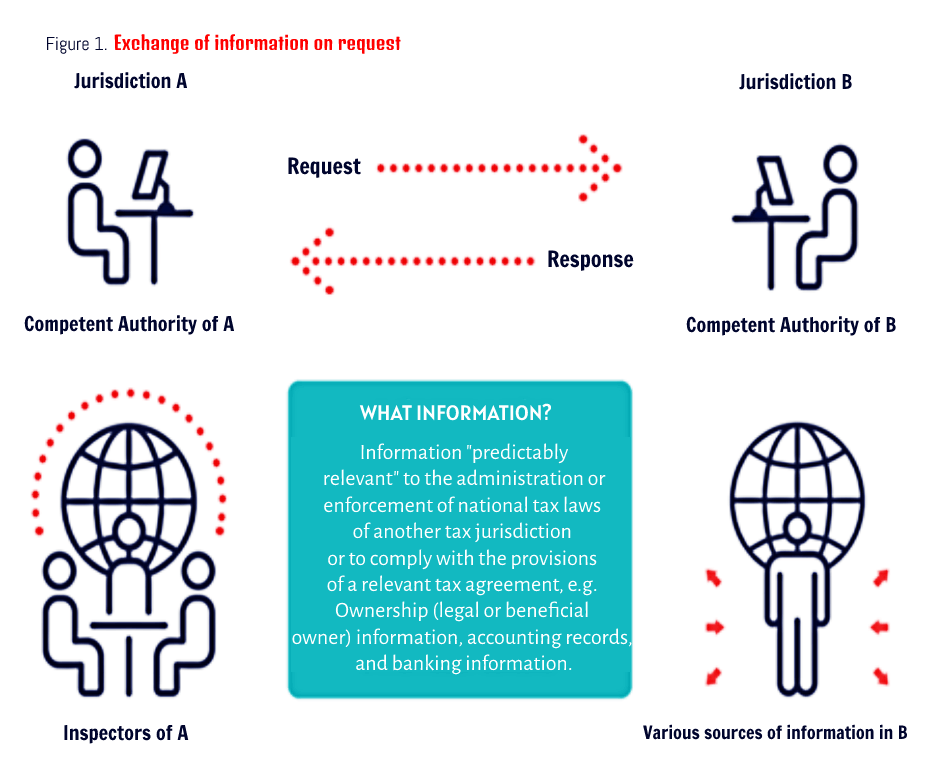

A fundamental tool for the Latin American Tax Administrations: the exchange of Tax Information | Inter-American Center of Tax Administrations

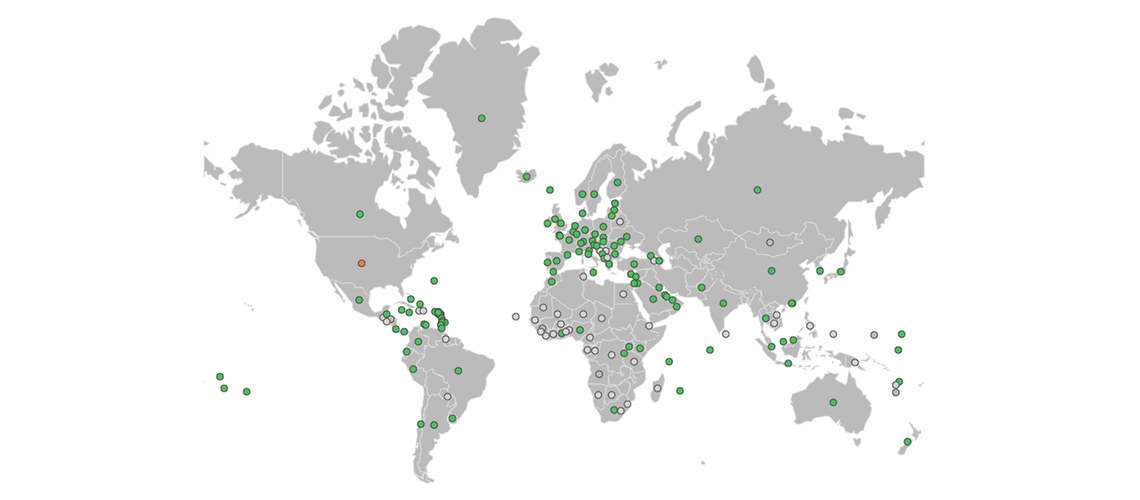

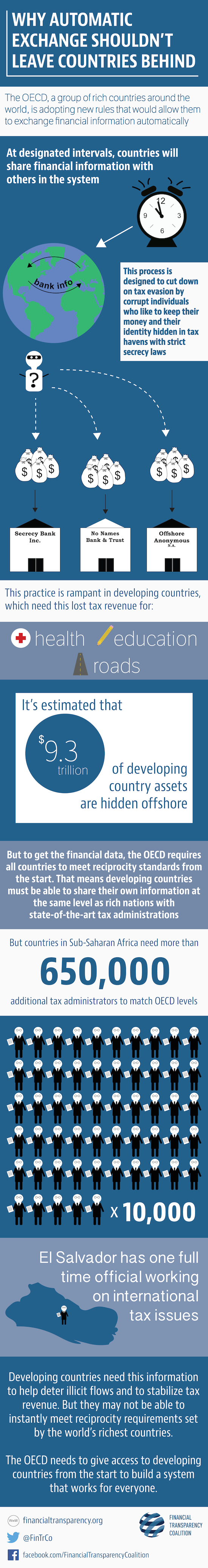

INFOGRAPHIC: Automatic Exchange of Information Shouldn't Leave Countries Behind - Financial Transparency Coalition